The word “investing” can mean many different things to different people. To one person, investing might mean spending hours every day hunting for the next big stock. But, to someone else, investing could mean buying one property, renting it out, and checking back in on it once a year. It all depends on whether you want to be an active or a passive investor. Let’s examine the difference between the two and help decide which one is better for you.

What Is Active Investing?

Active investing is an investment strategy that involves continued buying and selling by the investor. In other words, the investor is actively managing their portfolio by buying/selling different securities all the time. The most common example of an active investor is someone who day trades in the stock market.

Daytrading

A day trader is someone who buys and sells different stocks every single day. They usually do not necessarily care about holding these stocks for the short term. Instead, their goal is to profit from short-term fluctuations in the stock’s price.

For example, the investor might have a hunch that a certain company is going to shatter its earnings expectations for the previous quarter. If the company reports good news, the stock will surely spike. So, before the earnings announcement, the trader loads up on shares of the company. Then, after the announcement, the trader sells their shares. They take their profit (or loss) and are off searching for the next opportunity.

In this sense, the day trader actively manages their portfolio with constant buying and selling. But, active investing isn’t only for people trading stocks. You can actively invest in pretty much any asset.

“Buy And Flip” Real Estate Investors

Another example of an active investor is a real estate investor that buys and flips properties. Similar to the day trader, a buy-and-flip real estate investor usually doesn’t care about holding properties for the long term. Instead, they are looking to buy a property, fix it up, and sell it as soon as possible at a profit. Just like the day trader, this investor is trying to make a short-term profit from their investments by buying and selling quickly.

What’s Passive Investing?

Passive investing is a strategy that involves buying an investment and holding it for the long term, with minimal buying and selling. The passive investor isn’t trying to make a short-term profit off of an investment. Instead, they are interested in the long-term appreciation that will come with holding that asset.

In the stock market, many passive investors will buy and hold index funds.

Index Fund Investors

An index fund is a fund that tracks a wide range of different stocks. The most common example is the S&P 500, which tracks the movements of the 500 largest companies in the United States.

Instead of trying to time the market, passive investors prefer to just invest their money and let time do its thing. They don’t care if they make a profit in the short term because they know that, over a longer period of time, the stock market will appreciate in value. Additionally, they can minimize any losses that they might sustain from selling while stocks are down.

Keep in mind that passive stock investors don’t need to only buy index funds. They can also buy individual stocks with good long-term prospects. This might include companies like Apple, Amazon, or Google.

Again, investors can use a passive investing strategy across a range of different assets.

Active Vs Passive In Real Estate

Another thing to note is that when it comes to real estate specifically, the phrases active and passive can have slightly different meanings.

Active Real Estate Investors

In real estate, an active investor is also considered a property owner who takes an active role in managing his/her properties.

For example, let’s consider a real estate investment syndication which is made up of both active and passive investors. In these types of funds, the active investor(s) is known as the general partner (GP), syndicator, or sponsor. They are the one that runs the fund so that other investors can passively invest.

The general partner is responsible for activities like:

- Acquiring properties: This includes researching things like population trends, job growth, and income growth to identify key markets.

- Underwriting: Once the GP has identified a property they need to ensure that the property matches the criteria of the fund and will yield a successful investment.

- Negotiating/closing: Once the deal is in place, the GP needs to acquire financing and negotiate things like the property’s price, loan terms, closing costs, etc.

- Managing the property: The GP typically takes an active role in managing the property which includes collecting rents, handling maintenance, communicating with clients, and so on.

- Sale: Finally, when the time comes, the GP needs to decide when the best time to exit a property is based on market conditions and cycles.

As you can see, the active investor is very involved in the day-to-day activities of the property.

On the other hand, a passive real estate investor is someone who brings capital to the deal but does not have a management role. In other words, they give their money to the active investor and do not have to do any of the activities listed above. They simply participate in the cash flow and final sale of the property.

As you can see, the two roles are quite different from each other. But, there are different advantages to each. For example, the active investor does much more work than the passive investor and therefore has more control over the direction of the fund and the investments that they make.

Meanwhile, the passive investor gets to sit back and enjoy their return but they do not have much control over the management team’s decisions.

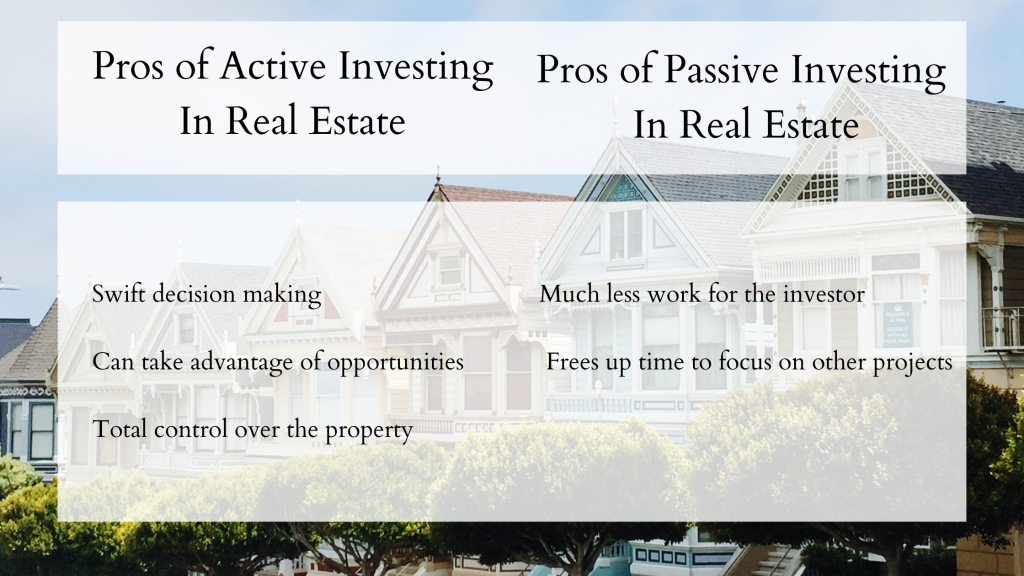

Here are the pros of active vs passive investing in real estate.

Finally, this brings us to the most important question.

So, Which is Better?

The answer is…it depends! Since all investors are different, there is no simple answer. The right answer for you will depend on your risk tolerance and personality type.

For example, if you have a winning investment strategy and a strong work ethic then it makes sense to actively manage a real estate portfolio to try and maximize your return. But, that doesn’t mean that passive investing is a bad strategy. In fact, passive investing is a great strategy for anyone who wants to enjoy the benefits of real estate investing but doesn’t have a lot of time to spend on it.

The key is to ask yourself these few questions:

- Do I have a lot of time to dedicate to my investments?

- Am I willing to put in extra work?

- Do I care more about maximizing my investment returns? Or protecting my money?

If you answered “yes” to both and care most about maximizing your returns, then active investing is your best option. If you answered “no” to both questions and care most about keeping your schedule free then you should pursue a passive strategy.

Finally, remember that you can also blend the two strategies. For example, you can passively invest in a real estate syndication (passive) while day trading stocks (active). Or, you can invest in an Individual Retirement Account (passive) while actively managing a real estate syndication.

We hope that you’ve found this article on active vs passive investing to be valuable! We hope that it has given you a better idea of the different styles of investors and which one might be the best fit for you!

If you’re interested in learning more please subscribe below to get alerted of new articles as we write them. Also, please follow along with Avatar Equity and Sachin Maskey on social media to get alerted of any updates.

Sachin Maskey is a physician, real estate investor, philanthropist, and entrepreneur. He has over 17 years of expertise in the medical industry as a family medicine specialist. Outside of medicine, he is the founder of the commercial real estate investment firm Avatar Equity as well as the Dhana Yoga Foundation. You can follow along with Sachin on Instagram, TikTok, Facebook, and LinkedIn.